Hey Gotraders,

Thousands of websites and apps around the world, including CNN, the New York Times, Amazon (AMZN), Hulu, Spotify (SPOT), Reddit, and even the UK government website, went dark yesterday. What?! Who broke the internet?!

The answer to that question is Fastly (FSLY).

Who is Fastly? Fastly is a cloud service provider that operates what’s known as a Content Delivery Network (CDN). CDNs are networks of servers and data centers distributed around the world that allow for the transfer of assets needed for loading Internet content. Fastly basically stores content on servers that are physically closer to its users so that content would load faster.

What happened? Well, it seems like Fastly caused the outage. Yikes! The outage was a result of “an undiscovered software bug.” The issue was resolved within an hour. The Internet isn’t broken anymore! Hallelujah!

"The problem with the internet is it's always there until it isn't," said David Vaskevitch, CEO of photo app Mylio and former Microsoft (MSFT) Chief Technical Officer. "For a system with so many interconnected parts, it's not always reliable. Any one fragile part can bring it down."

Why is this important? Fastly is a service that is widely used by web publishers. The extent of which became apparent when the outage occcured. A couple of similar incidents have occured recently - Cloudflare was hit with an outage last July, and Amazon Web Services went down last November.

These incidents highlight the fact that a technical hiccup in a single company can have global ramifications.

📈 Wish stock is up nearly 50% 🚀

The Redditors are at it again. This time they are focusing their attention on Wish (WISH). Their stock closed at $11.63, up 49.87% yesterday. Really?! Yes!

This is surprising considering the fact that a shareholder class-action suit was filed yesterday. The suit claimed that senior executives at Wish misled investors by inflating its figures.

📉 MicroStrategy sells $500 million worth of junk bonds to buy more bitcoin 🤨

MicroStrategy (MSTR) really wants to buy Bitcoin but they don’t have the cash. So what are they doing about it? They are selling junk bonds in order to raise cash to finance their Bitcoin shopping spree. 🛒

What are junk bonds? A bond is pretty much an IOU. Bond issuers promise to pay interest payments along with the principal sum in exchange for buying the bond. Junk bonds represent bonds issued by companies that have a high risk of defaulting on the interest and principal sum to their investors.

Stocks of MicroStrategy closed at $459.38, down 2.22% yesterday.

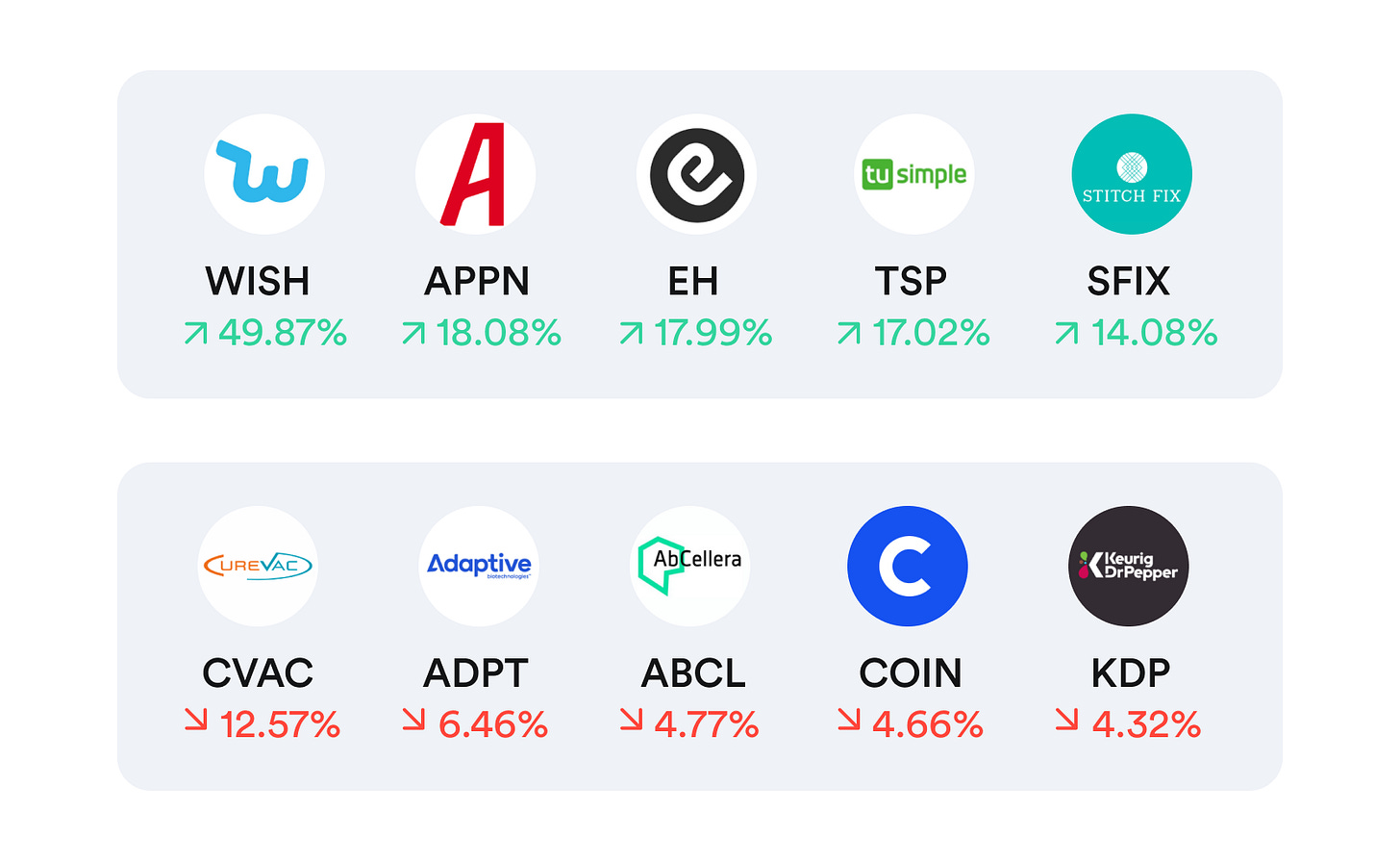

Top movers & shakers 🎢

What else is making headline news 📰

Apple (AAPL) is encroaching on Facebook’s (FB) territory like never before with new social features.

El Salvador becomes the first country to adopt Bitcoin as legal tender.

U.S. recovers $2.3 million in bitcoin paid in the Colonial Pipeline ransom.

Popular companies releasing earnings this week 💰

Wednesday: Jack Daniel’s (BF.B), GameStop (GME), Campbell Soup (CPB)

Thursday: Adobe (ADBE), Chewy (CHWY), Plug Power (PLUG), FuelCell Energy (FCEL), Manchester United (MANU)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).