Prices of oil and gold surge as Russia-Ukraine crisis escalates 🚀

Tuesday, 22nd February 2022 by Gotrade

Hey Gotraders,

The U.S. markets are open tonight.

We wrote about the impact of the Russia-Ukraine situation on global markets in yesterday’s edition of Gotrade Daily.

The situation is escalating, and Russia has sent troops to eastern Ukraine - Donetsk, and Luhansk. Putin sent troops in saying that he would recognize their independence.

But other world leaders remain skeptical and have condemned his actions and said that they were a “blatant violation of international law.”

According to the UK minister, the invasion of Ukraine has begun, and the chances of a full-scale invasion of Ukraine are very, very high.

So, what is happening on the world stage at the moment?

Biden has ordered sanctions to be levied on the 2 regions that Russia invaded. This means that new investment, trade, and financing by U.S. persons to, from, or in the so-called Donetsk People’s Republic and Luhansk People’s Republic regions of Ukraine will be prohibited

The UN Security Council are meeting to discuss the crisis

Bitcoin and other cryptocurrencies are affected by the mounting Russia-Ukraine tensions

The German chancellor has halted the approval of gas pipeline Nord Stream 2 after Russia’s actions

U.S. markets were braced for losses, with S&P 500 futures down 1.4% and Nasdaq futures off 2.1% at the time of writing

It may seem like bad news all around, but that’s not true.

The prices of oil and gold are surging. Oil prices were up by nearly 5% following news of Putin sending troops into eastern Ukraine.

"We can be pretty confident that this will put upward pressure on oil markets and will be watching gas prices pretty nervously as we wait to see what sanctions are introduced" - Kit Juckes, Macro Strategist at Societe Generale.

Analysts are even expecting the price of oil to hit a whopping $150 per barrel.

The price of spot gold was up 0.1% to $1,908. Prices hit a new six-month top of just under $1,913 earlier. Analysts are expecting prices to keep going up if the tensions continue.

"If the Ukraine crisis escalates further, we believe that gold will remain in demand amid the increased risk aversion, meaning that its price will probably make further gains" - Commerzbank analysts.

Why is this important? It is extremely important to have a diversified portfolio. This is a perfect example why. While U.S. equities are down, oil and gold are up. Need I say more? 😉

Check out our “Commodities” category on the Gotrade app to invest in oil and gold-related stocks and ETFs.

📉 DraftKings shares close down over 21% after reporting earnings ⏬

DraftKings (DKNG) reported better than expected earnings and revenue. They reported a loss of 35 cents per share on $473 million revenue while analysts were expecting a loss of 81 cents per share on $445 million revenue.

However, shares plunged a whopping 21% after the company revised up its expected 2022 loss from an estimated adjusted EBITDA loss of $572.7 million to somewhere between $825 million and $925 million. Yikes!

Is the CEO worried? Not at all.

“It’s a wild market right now. I think what we’re doing has been very consistent since day one… I think the model’s working, and we’ll play the long game here… I’m very confident that once the market settles down and rationality kicks back in, that the metrics we’re putting out there will start to resonate…. But in the meantime, we’ve just got to keep doing our thing and hopefully the market will catch on” - CEO Jason Robins.

Shares of DraftKings closed at $17.29, down 21.62% for the day.

📉 Credit Suisse is under scrutiny after data leak 🧐

Uh oh… Someone’s in trouble! Credit Suisse (CS) suffered a massive data leak over the weekend.

The leaked records of over 18,000 Credit Suisse accounts were uncovered. The accounts belonged to shady characters. Uhhh… This included an Algerian general accused of torture, the children of a brutal Azerbaijani strongman, and even a Serbian drug lord known as Misha Banana. Whattt?! This is unbelievable! Also, I wonder who would take a drug lord by the name of Banana seriously?!

A whistleblower shared his findings with the German newspaper Süddeutsche Zeitung. Oh, my…

“The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders…This situation enables corruption and starves developing countries of much-needed tax revenue” - the whistleblower.

Credit Suisse has denied any wrongdoing and said that they “strongly reject” the accusations being made.

The bank is now under scrutiny. Swiss regulator FINMA is looking into the matter. The European People’s Party is even urging the European Commission to re-classify Switzerland as a high-risk money-laundering country!

Shares of Credit Suisse closed at $8.93, down 9.98% year-to-date.

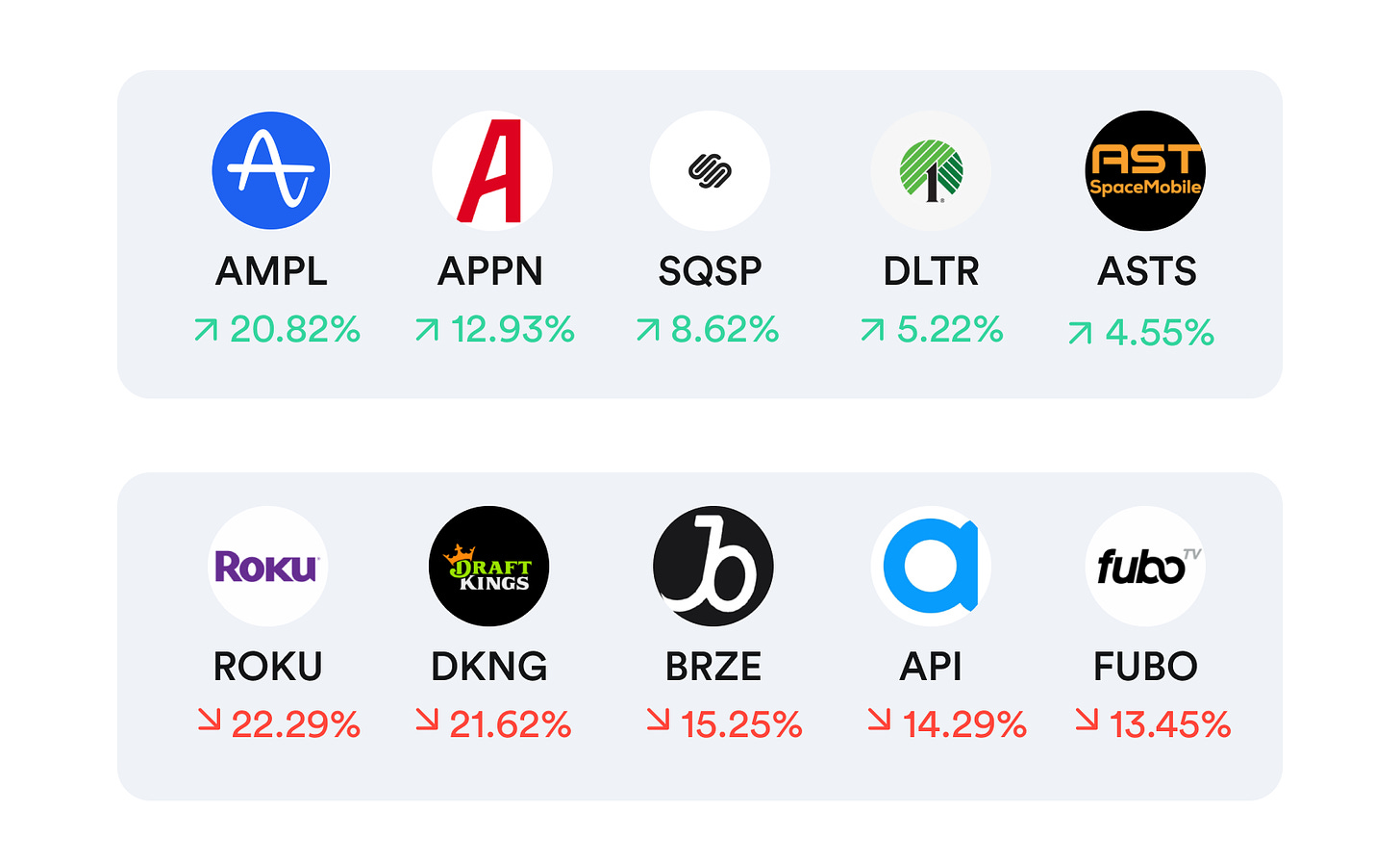

Top movers & shakers 🎢

What else is making headline news 📰

The chance of a full-scale invasion of Ukraine is ‘very, very high,’ analyst says.

Bitcoin and other cryptocurrencies sink on mounting Russia-Ukraine tensions.

Walmart (WMT) chases fashion clout with designer Brandon Maxwell’s debut spring collection.

After Tesla (TSLA) CEO Elon Musk alleged ‘unrelenting investigation,’ SEC pushes back.

HSBC (HSBC) brings key profit target forward on rising rates as annual earnings double.

Tesla’s (TSLA) Autopilot feature is reportedly being investigated by German regulators.

Home Depot (HD) beats estimates, retailer says it sees sales growth ahead for 2022.

Popular companies releasing earnings this week 💰

Tuesday: Virgin Galactic (SPCE), Krispy Kreme (DNUT), Home Depot (HD), HSBC (HSBC), Medtronic (MDT), Public Storage (PSA), Nubank (NU), Agilent Technologies (A), Cadence Design (CDNS), Realty Income (O), Verisk Analytics (VRSK), Diamondback Energy (FANG), Expeditors (EXPD), Caesars (CZR), Avangrid (AGR), InterCon Hotels (IHG), Teladoc (TDOC), Toll Brothers (TOL), McAfee (MCFE), Hercules Capital (HTGC), Agora (API)

Wednesday: FuboTV (FUBO), Lowe's (LOW), Booking.com (BKNG), Jumia (JMIA), TJX (TJX), eBay (EBAY), ANSYS (ANSS), Cerner (CERN), Live Nation Entertainment (LYV), Agnico Eagle (AEM), Extra Space Storage (EXR), Ingersoll Rand (IR), Entergy (ETR), NetApp (NTAP), VICI Properties (VICI), Fidelity National Financial (FNF), Bath & Body Works (BBWI), Molson Coors (TAP), Bausch Health (BHC), Five9 (FIVN), Vipshop (VIPS), Owl Rock Capital (ORCC), Herbalife (HLF), Innovative Industrial (IIPR), Amedisys (AMED), Figs (FIGS), Whiting Petroleum (WLL), Oasis Petroleum (OAS), Lemonade (LMND), Skillz (SKLZ), All Birds (BIRD), Arko (ARKO), Newtek (NEWT), The Honest Co (HNST), Kaltura (KLTR)

Thursday: Coinbase (COIN), Square (SQ), Moderna (MRNA), Beyond Meat (BYND), Nikola (NKLA), Main Street Capital (MAIN), AbCellera (ABCL), Osisko Gold (OR), BridgeBio Pharma (BBIO), Amwell (AMWL), Provention Bio (PRVB), Alibaba (BABA), Intuit (INTU), American Tower (AMT), Dell (DELL), Vale (VALE), Newmont (NEM), Dr Pepper (KDP), VMware (VMW), Autodesk Inc. (ADSK), Monster (MNST), American Electric Power (AEP), Occidental (OXY), CB Richard Ellis (CBRE), Public Service Enterprise (PEG), Telefonica (TEF), Edison International (EIX), Etsy (ETSY), Discovery (DISCK), Quanta Services (PWR), AES (AES), Plug Power (PLUG), American Homes (AMH), Iron Mountain (IRM), Enel Americas (ENIA), Morningstar (MORN), Carvana (CVNA), Universal Health (UHS), AEGON (AEG), Gaming & Leisure Properties (GLPI), CubeSmart (CUBE), NRG Energy (NRG), Norwegian Cruise (NCLH), Opendoor (OPEN), Farfetch (FTCH), DigitalOcean (DOCN)

Friday: Berkshire Hathaway (BRK.B), Anheuser-Busch (BUD), CIBC (CM), Sempra Energy (SRE), Li Auto (LI), Icahn Enterprises (IEP), Evergy (EVRG), Pinnacle West Capital (PNW), Qurate Retail (QRTEA), Cronos Group (CRON)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: Gotrade Securities, trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of Gotrade Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. Gotrade Securities is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).