Hey Gotraders,

Streaming giant Netflix (NFLX) reported earnings yesterday and the results were.. umm.. mixed. Here’s what they reported:

Earnings per share: $2.97 actual vs $3.16 expected

Revenue: $7.34 billion actual vs $7.32 billion expected

Global paid net subscriber additions: 1.54 million actual vs 1.19 million expected

They missed on earnings but beat expectations on revenue and global paid net subscriber growth numbers.

Netflix said its revenue growth this past quarter came from an 11% increase in average paid streaming memberships and an 8% growth in average revenue per membership.

“COVID has created some lumpiness in our membership growth (higher growth in 2020, slower growth this year), which is working its way through. We continue to focus on improving our service for our members and bringing them the best stories from around the world” - Netflix.

Netflix expects to add 3.5 million net subscriber additions in the third quarter, while analysts were expecting 5.46 million. Yikes!

Why is this important? It seems like the streaming space is getting very crowded. Netflix has been looking to expand their portfolio of products by moving into the gaming space soon. The focus will be on mobile games initially. Netflix mentioned that potential games will be included in Netflix subscriptions at no additional cost. This is a whole new segment for them to try and capture. Once they tap into this segment, they could charge a fee in the future and turn it into an additional revenue stream!

“We’re excited as ever about our movies and TV series offering and we expect a long runway of increasing investment and growth across all of our existing content categories, but since we are nearly a decade into our push into original programming, we think the time is right to learn more about how our members value games” - Netflix.

📈 Chipotle stock is up over 5% in extended trading 🆙

Shares of Mexican fast-food chain Chipotle (CMG) is up over 5% in extended trading after they reported earnings. They beat analysts’ expectations on both earnings & revenue. They reported earnings of $7.46 on $1.89 billion revenue while analysts were expecting earnings of $6.52 on $1.88 billion revenue. Well done!

Chipotle stock closed at $1,574.35 yesterday, up 1.44% and they are up a further 5.44% in extended trading at time of writing.

📈 United Airlines closes up over 6% higher 🚀

United Airlines (UAL) reported a loss of $3.91 per share, which was in line with analysts’ expectations during their earnings call. However, they reported $5.47 billion in revenue which topped analysts’ expectations of $5.37 billion. United mentioned that they expect to be profitable for the next two quarters. Seems like they are optimistic about travel rebounding back. ✈️

United Airlines stock closed at $46.32, up 6.58% yesterday. Stock is up a further 1.51% in extended trading at time of writing.

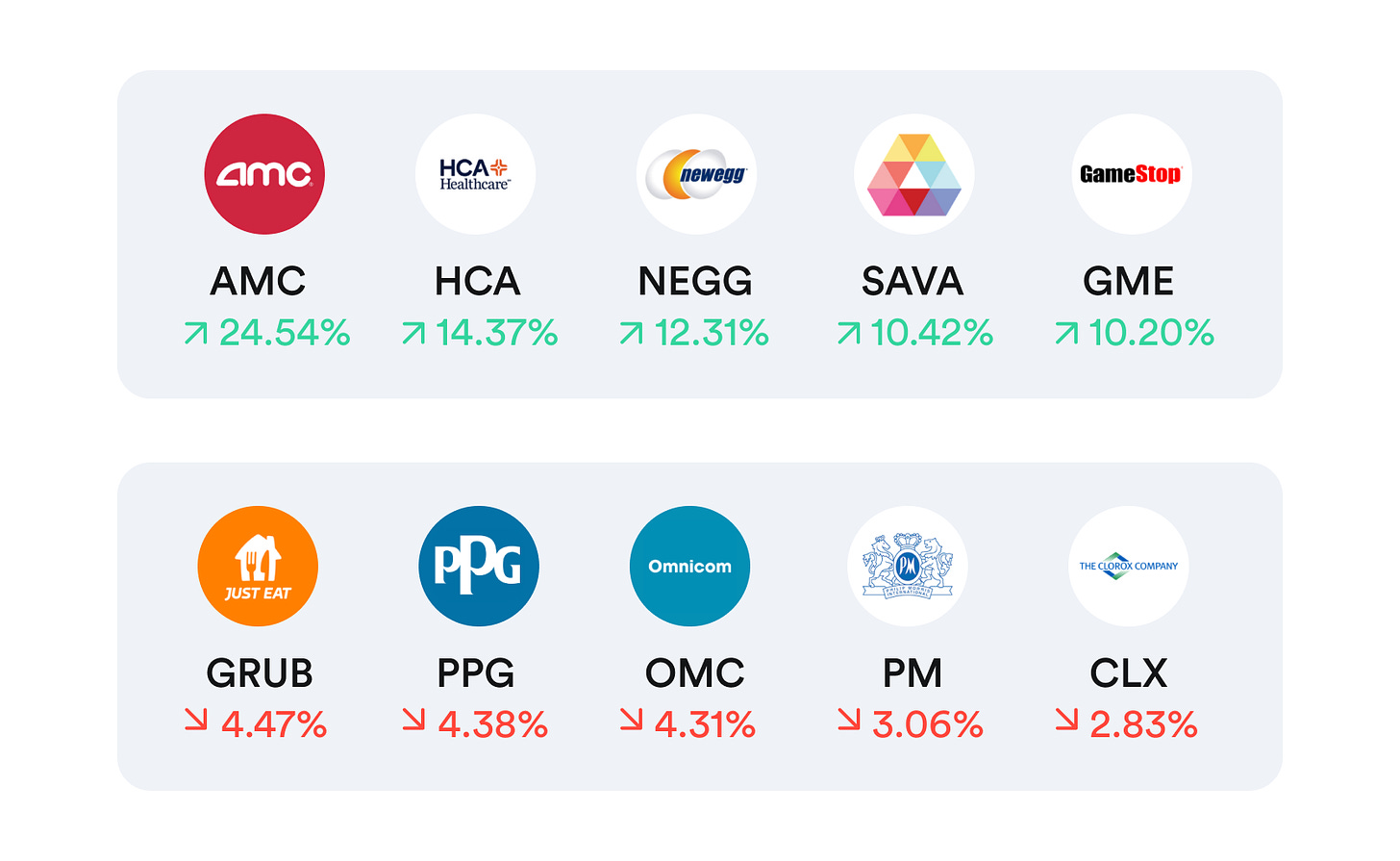

Top movers & shakers 🎢

What else is making headline news 📰

WHO chief warns that the world is going into the ‘early stages of another wave.’

Video: What Jeff Bezos’ successful Blue Origin launch means for space tourism - CNBC After Hours.

SAP (SAP) lifts outlook as cloud push gains traction in the second quarter.

Watch these key levels for bitcoin next after its break below $30,000, traders say.

Popular companies releasing earnings this week 💰

Wednesday: Verizon (VZ), Johnson & Johnson (JNJ), Coca-Cola (KO), Harley Davidson (HOG), Seagate Technology (STX), Nasdaq (NDAQ)

Thursday: Dow, Inc (DOW), Freeport-McMoran (FCX), Twitter (TWTR), Domino’s Pizza (DPZ), Snapchat (SNAP), Unilever (UL)

Friday: American Express (AXP), Honeywell (HON), Schlumberger (SLB), NextEra Energy (NEE), Kimberly Clark (KMB)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).