Microsoft is shutting down its local version of LinkedIn in China 🙅♀️

Friday, 15th October 2021 by Gotrade

Hey Gotraders,

Let’s end off the week by taking a look at what’s going on with Microsoft (MSFT). The tech giant announced that it will be shutting down its local version of LinkedIn in China.

The reason? It is becoming increasingly difficult for social media companies to keep up with Chinese regulations and state censorship. Earlier this year, regulators in China told LinkedIn to better moderate its content and gave it a 30-day deadline.

Last month, LinkedIn blocked the profiles of several U.S. journalists in China, citing “prohibited content” on their profiles. The profiles of academics and researchers have also been reportedly blocked on the platform in China in recent months.

So, what happens to LinkedIn in China now? LinkedIn will launch a jobs-only version of the site, called InJobs, later this year. This will not include a social feed or the ability to share or post articles. Boo!

"We're facing a significantly more challenging operating environment and greater compliance requirements in China. While we are going to sunset the localised version of LinkedIn in China later this year, we will continue to have a strong presence in China to drive our new strategy and are excited to launch the new InJobs app later this year" - Mohak Shroff, Senior Vice President at LinkedIn.

Why is this important? Several players have exited the scene. Twitter (TWTR) and Facebook (FB) have been blocked in the country for over a decade now, and Google (GOOG) decided to shut down operations in 2010. LinkedIn was the last major U.S. social network that was still standing, but they too have now succumbed…

What do experts think about the widescale crackdown going on in China? Well, according to a former Chief Economist at the International Monetary Fund, China risks making “big mistakes” as it cracks down on large swathes of its economy from technology, to private tutoring and real estate.

Microsoft’s decision could very possibly wind up being a key moment in the bigger picture of China’s decoupling from the rest of the world. Hmmm…

📉 Virgin Galactic is down over 20% in extended trading 🙈

Virgin Galactic (SPCE) was given the go-ahead to resume commercial flights after the FAA concluded its investigation. Barely a couple of weeks later, Virgin Galactic has announced that they will be delaying the launch of their commercial space flights to the fourth quarter of 2022. And just like that, the stock crashed and burned... over 20%… Ouch!

Shares of Virgin Galactic closed at $24.06 but are down 20.62% in extended trading at the time of writing.

📈 Big Banks report earnings 💰

Big Banks reported earnings and they all had stellar earnings this quarter. All 4 banks that reported earnings yesterday beat Wall Street’s expectations on earnings and revenue. Cha-ching! Let the cash start rolling in…

Bank of America (BAC) closed at $45.07, up 4.52%. Stock is up 0.67% in extended trading.

Morgan Stanley (MS) closed at $101.01, up 2.52%. Stock is up 0.49% in extended trading.

Wells Fargo (WFC) closed at $45.31, down 1.54%. Stock is up 0.40% in extended trading.

Citigroup (C) closed at $70.80, up 0.75%. Stock is up 0.96% in extended trading.

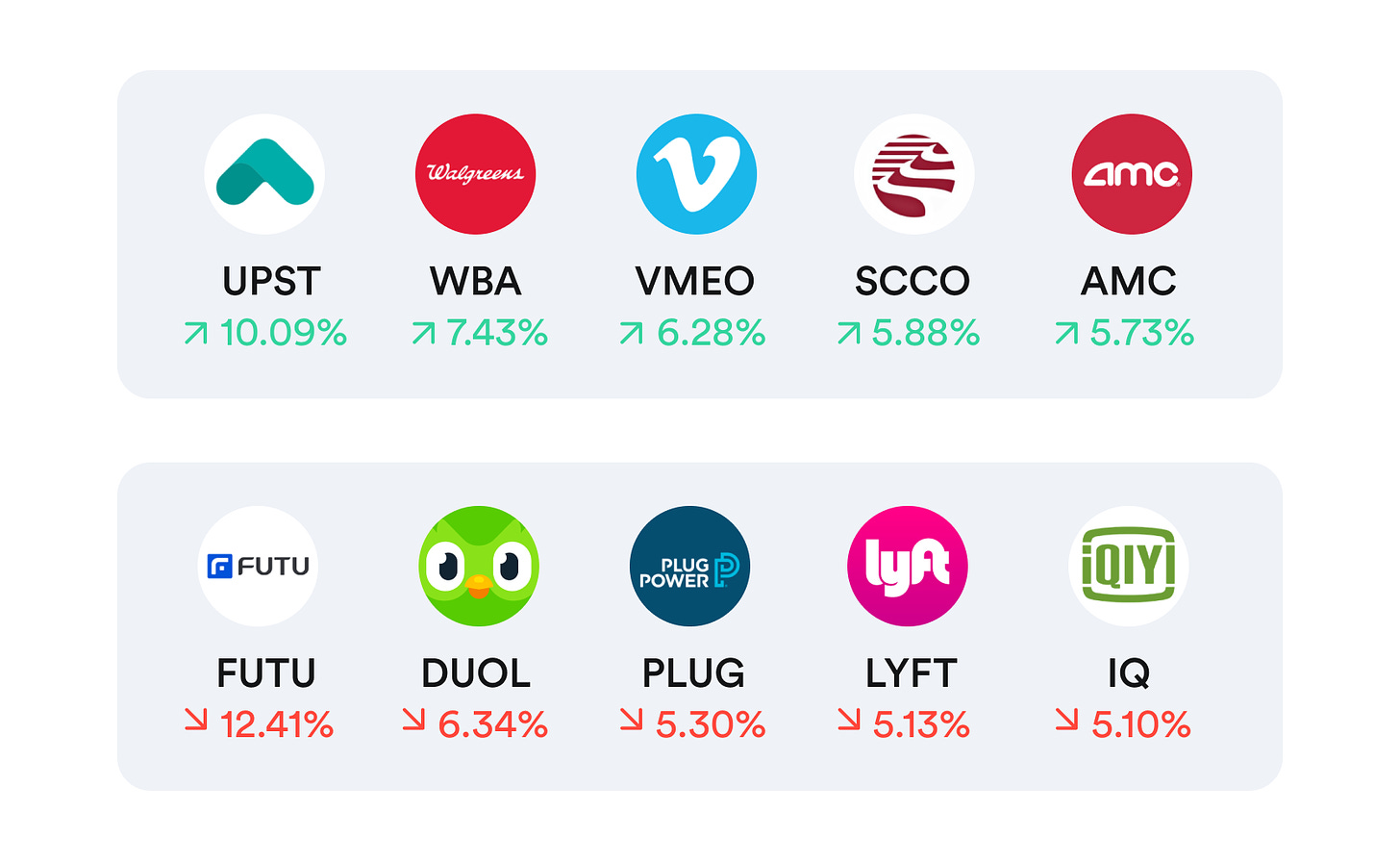

Top movers & shakers 🎢

What else is making headline news 📰

Facebook (FB) captured more than 2,000 hours of first-person video to train next-generation A.I.

Bitcoin is inches away from reaching $60,000 amid ETF speculation.

Chip shortage could persist for another 2 to 3 years, major Chinese consumer goods maker warns.

Klobuchar, Grassley to lead antitrust bill barring Big Tech from disadvantaging rivals.

McDonald's (MCD), Yum Brands (YUM), and Krispy Kreme (DNUT) stand out in Morgan Stanley's (MS) restaurant sector earnings preview.

FDA panel unanimously recommends Moderna (MRNA) Covid booster shots for at-risk adults.

S&P 500 jumps the most since March, powered by better-than-expected earnings.

Walgreens (WBA) earnings top estimates, as drugstore gives twice as many Covid vaccines as expected.

Video: Tom Lee doubles down on $100k year-end price target for Bitcoin.

Coinbase (COIN) NFT marketplace owns dominance with 1M sign-ups in a day.

Popular companies releasing earnings this week 💰

Friday: J.B. Hunt Transport (JBHT), Prologis (PLD), PNC Financial (PNC), Truist (TFC), Goldman Sachs (GS)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).