Hey Gotraders,

This is a busy week with companies like Alibaba (BABA), Pfizer (PFE), Moderna (MRNA), Square (SQ), Uber (UBER), AMC (AMC), Tinder (MTCH), Ferrari (RACE) and many more due to report earnings. Refer to our earnings calendar to see popular companies releasing earnings this week! 👇

It was an equally busy week last week with Big Tech reporting earnings. Here’s a quick recap of what went down last week.

Google (GOOG) reported earnings that beat analysts’ expectations on both the top and bottom lines.

Apple (AAPL) and Amazon (AMZN) both reported less than uhh.. favorable… earnings due to supply chain issues. Apple is having issues fulfilling the demand for its products due to the global chip shortage. “The supply constraints were driven by the industry-wide chip shortages that have been talked about a lot, and COVID-related manufacturing disruptions in Southeast Asia” - Tim Cook, CEO of Apple.

The losses incurred by Apple as a result of the supply chain issues are estimated to be a whopping $6 billion! Mr Cook also expects the issue to get worse in the December quarter. Uh oh….

Apple was the first company to reach a $1 trillion and $2 trillion market cap. Apple took the title of the world's most valuable publicly-traded company last year when it overtook Saudi Aramco in market cap.

And now, it’s time for them to hand over the title to Microsoft! 🏆

Microsoft had a market cap of nearly $2.49 trillion at market close on Friday, while Apple's stood at about $2.46 trillion.

Big yay for Microsoft, but big ouch for Apple!

Why is this important? It seems like the fight for position of world’s most valuable company is a close one. Microsoft last topped Apple in market cap in 2020 when the pandemic created havoc on supply chains as well. Microsoft first closed above a $2 trillion market cap in June after revealing the first major update to Windows in more than five years.

Apple and Amazon closed down 1.82% and 2.15% respectively. Google and Microsoft closed up 1.47% and 2.24% respectively.

📉 Cathie Wood buys the dip on Robinhood 🛒

When stocks crash, guess who sees it as an opportunity to buy the dip? You guessed it right! Cathie Wood - Founder of Ark Invest. Shares of Robinhood (HOOD) were down over 10% last week over disappointing earnings. Cathie Wood went out and bought nearly $80 million worth of the stock. Wow!

That’s not all, though. She also bought Twilio (TWLO), and Teladoc Health (TDOC).

Shares of Robinhood closed at $34.97, down 12.25% over the last 5 days.

📈 Facebook’s new name 🤔

So, we all knew that Facebook (FB) was going to rebrand itself. They were going to find a new name for the company that would match up with Mark Zuckerberg’s vision for the company to become a “metaverse.”

So, it comes as no surprise when the company renamed itself to… wait for it… “Meta Platforms.” 🤦 What an obvious choice!

Shares of Facebook closed at $323.57, up 2.10% on Friday.

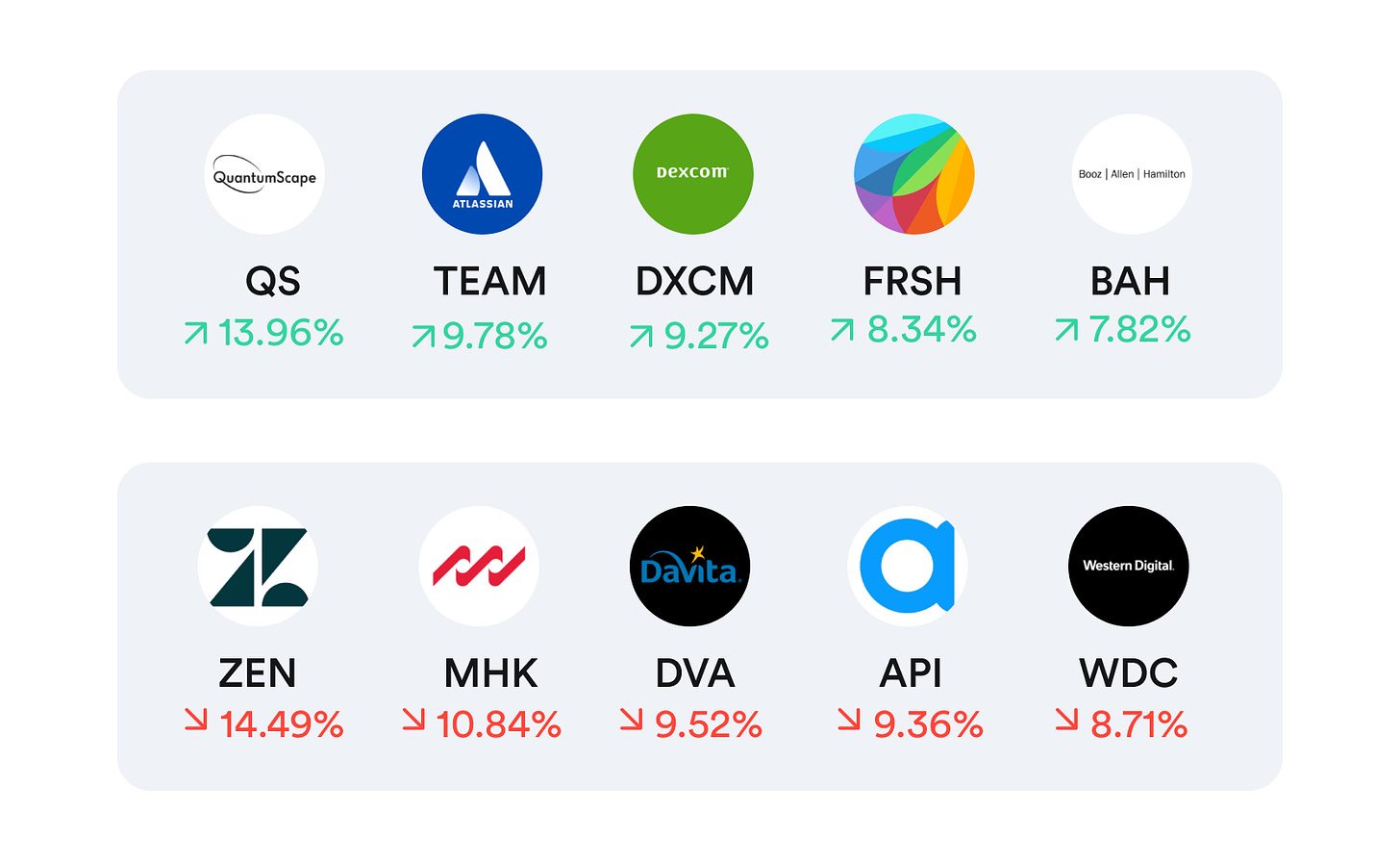

Top movers & shakers 🎢

What else is making headline news 📰

Palantir (PLTR) - It's earnings season and Palantir is set up for a breakout above $30.

Elon Musk to Congress: Drop the billionaire tax. It will only mess with ‘my plan to get humanity to Mars’.

American Airlines (AAL) cancels more than 600 flights on Sunday.

Jay Leno: Elon Musk is the reason Tesla (TSLA) is the most valuable car company in the world.

Starbucks (SBUX) revenue falls short as Covid hurts China sales, coffee chain offers mixed fiscal 2022 outlook.

XPeng (XPEV) shares rise after Chinese EV maker delivers more than 10,000 cars for the second month in a row.

Gaming platform Roblox (RBLX) comes back online after three-day outage.

Global Covid deaths hit 5 million as pandemic takes staggering toll.

Popular companies releasing earnings this week 💰.

Monday: Diamondback Energy (FANG), Realty Income (O), Ryanair (RYAAY), Clorox (CLX), AMC (AMC), and more..

Tuesday: Tinder (MTCH), Ferrari (RACE), Pfizer (PFE), T-Mobile (TMUS), British Petroleum (BP), Cadbury (MDLZ), Herbalife (HLF), Estee Lauder (EL), Under Armour (UAA), Lyft (LYFT), ConocoPhillips (COP), Activision (ATVI), KKR (KKR), Prudential Financial (PRU), Marathon Petroleum (MPC), Polo Ralph Lauren (RL), Western Union (WU), and more..

Wednesday: Qualcomm (QCOM), CVS Health (CVS), Booking.com (BKNG), Marriott (MAR), Roku (ROKU), Electronic Arts (EA), Manulife (MFC), HubSpot (HUBS), Etsy (ETSY), Fox (FOX), Take-Two Interactive (TTWO), 10X Genomics (TXG), Marathon Oil (MRO), Hyatt (H), TuSimple (TSP), Michael Kors (CPRI), Fastly (FSLY), Vimeo (VMEO), and many more..

Thursday: Alibaba (BABA), Moderna (MRNA), Illumina (ILMN), Square (SQ), Airbnb (ABNB), Uber (UBER), Mercadolibre (MELI), Cloudflare (NET), Monster (MNST), Motorola (MSI), Pinterest (PINS), Peloton (PTON), Expedia (EXPE), ViacomCBS (VIAC), Kellogg's (K), DropBox (DBX), Novavax (NVAX), Wynn Resorts (WYNN), DigitalOcean (DOCN), Nikola (NKLA), and many more..

Friday: Berkshire Hathaway (BRK.B), Toyota (TM), Dish Network (DISH), DraftKings (DKNG), Pinnacle West Capital (PNW), Canopy Growth (CGC)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).