Hey Gotraders,

Meta (FB) has been in the news a lot lately. First, it was their earnings report that shook the markets. Then, they threatened to remove Facebook and Instagram in Europe.

Shares of Meta are down nearly 35% since the start of the year. As of yesterday’s closing price, Meta’s market cap fell just below $600 billion. This is a big deal as this hasn’t happened since May 2020. Yikes!

Until recently, Meta was among the five most-valuable U.S. companies, alongside tech superstars Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) and Google (GOOG). They have been bumped down to 8th place now. Tesla (TSLA) , Berkshire Hathaway (BRK.B) and Nvidia (NVDA) are all ahead of Meta.

On the bright side, Meta may avert potential antitrust cases as House legislators have picked “$600 billion” as the threshold that antitrust bills would apply to. These antitrist bills do not apply to companies with market caps below $600 billion.

Caveat - It might still take time for any of these bills to become law, if that happens at all. The language in the bills could be amended, and there might even be a clause that the bills would continue to apply for a period of time after companies fall below the market cap threshold.

Why is this important? Shares of Meta closed at $220.18, down 2.10% for the day. Based on 43 analysts, Meta has a “Moderate Buy” rating with a price target of $328.88.

📈 Peloton shares are up over 25% after the appointment of new CEO 👨💻

Shares of Peloton (PTON) are up a whopping 25% after the company announced a new CEO. John Foley, Peloton’s Founder, is leaving the company after past missteps. Bye bye, John Foley. Hello, Barry MccCarthy, Peloton’s incoming CEO.

“We own it. I own it. And we are holding ourselves accountable. That starts today” - John Foley.

That’s not all. The company is undergoing a massive restructuring. 2,800 workers will lose their jobs as a result. Ouch!

Peloton also slashed its full-year financial targets as it continues to lose money.

Shares of Peloton closed at $37.27, up 25.28% for the day. Shares are up a further 2.71% in extended trading at the time of writing.

📈 XPeng shares are rallying after being added to the Shenzhen-Hong Kong Stock Connect 🚀

XPeng’s (XPEV) Hong-Kong listed shares have been added to the Shenzhen-Hong Kong Stock Connect, which would allow Chinese investors to gain easier access to XPeng’s Hong Kong-listed shares.

“The inclusion will not only further expand and diversify our investor base but also provide the opportunity for our customers, partners and EV and technology investors in China to participate in our exciting growth story” - Brian Gu, President of XPeng.

Shares of XPeng’s Hong-Kong shares rallied as much as 11% before reversing slightly. Likewise, XPeng’s US-listed shares were also up.

Shares of XPeng closed at $37.17, up 0.84% for the day. Shares are up 5.73% in extended trading at the time of writing.

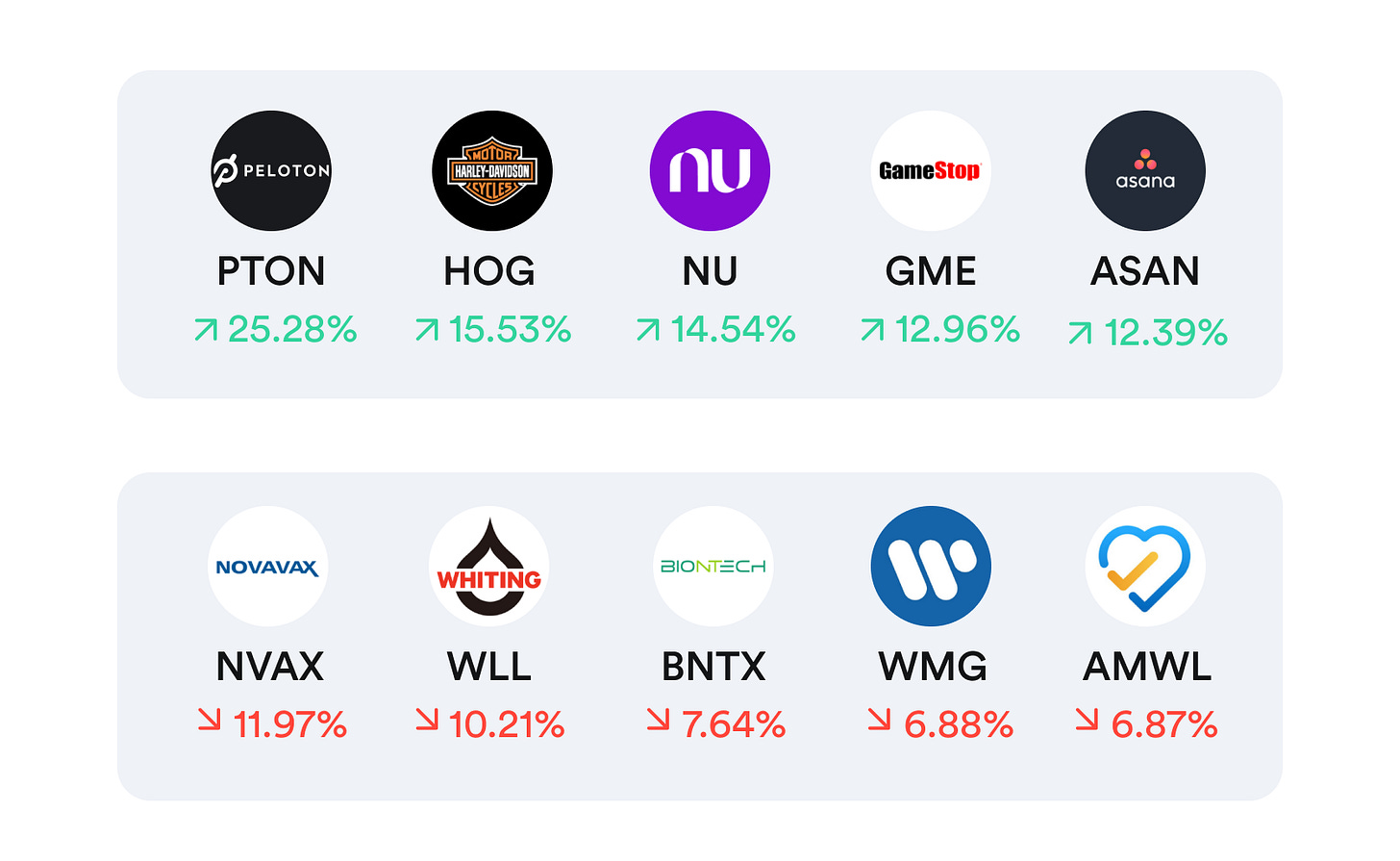

Top movers & shakers 🎢

What else is making headline news 📰

Biden finally acknowledges Tesla’s (TSLA) EV leadership after a year of silence.

Apple’s (AAPL) acquisition history shows why a Peloton (PTON) buy is out of the question.

Chipotle (CMG) shares rise on better-than-expected earnings, CEO says chain is ‘fortunate’ it can raise prices.

Toyota (TM) U.S. sales chief says win over GM ‘not sustainable,’ but expects bet on EVs to pay off.

Apple (AAPL) announces a way to buy stuff by tapping iPhones together.

Popular companies releasing earnings this week 💰

Wednesday: Toyota (TM), Disney (DIS), CVS Health (CVS), GlaxoSmithKline (GSK), CME Group (CME), Uber (UBER), Manulife (MFC), Motorola (MSI), Intl Flavors & Fragrances (IFF), Twilio (TWLO), Equifax (EFX), Cerner (CERN), CDW (CDW), Fox (FOX), MGM Resorts (MGM), Arch Capital (ACGL), Trimble (TRMB), Lumen Technologies (LUMN), ICL Group (ICL), American Financial (AFG), Annaly Capital (NLY), Ares Capital (ARCC), Zynga (ZNGA), Mattel (MAT), TuSimple (TSP), Figs (FIGS), Canopy Growth (CGC), TaskUs (TASK), Vimeo (VMEO), Remitly (RELY), The Honest Co (HNST), Pennantpark Floating Rate (PFLT), eSports Technologies (EBET)

Thursday: Expedia (EXPE), Twitter (TWTR), Coca-Cola (KO), Pepsi (PEP), AstraZeneca (AZN), Philip Morris (PM), Linde (LIN), Duke Energy (DUK), Moody's (MCO), Illumina (ILMN), Datadog (DDOG), Global Payments (GPN), DexCom (DXCM), Republic Services (RSG), Telus (TU), Cloudflare (NET), ArcelorMittal (MT), LabCorp (LH), Verisign (VRSN), DTE Energy (DTE), Kellogg's (K), HubSpot (HUBS), Bio-Rad Labs (BIO), Alnylam (ALNY), Affirm (AFRM), GoDaddy (GDDY), Regency Centers (REG), Zillow Group (ZG), AEGON (AEG), Zendesk (ZEN), Carlisle (CSL), DaVita (DVA), Mohawk Industries (MHK), Federal Realty Trust (FRT), Avalara (AVLR), Western Union (WU), Huntington Ingalls (HII), Freshworks (FRSH), Upwork (UPWK), Coursera (COUR), Aurora Cannabis (ACB)

Friday: Enbridge (ENB), Dominion Energy (D), Apollo Global (APO), Coupang (CPNG), Fortis (FTS), Ares Management (ARES), Under Armour (UAA), Warby Parker (WRBY), F45 Training (FXLV), Kredivo (VPCB)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: Gotrade Securities, trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of Gotrade Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. Gotrade Securities is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).