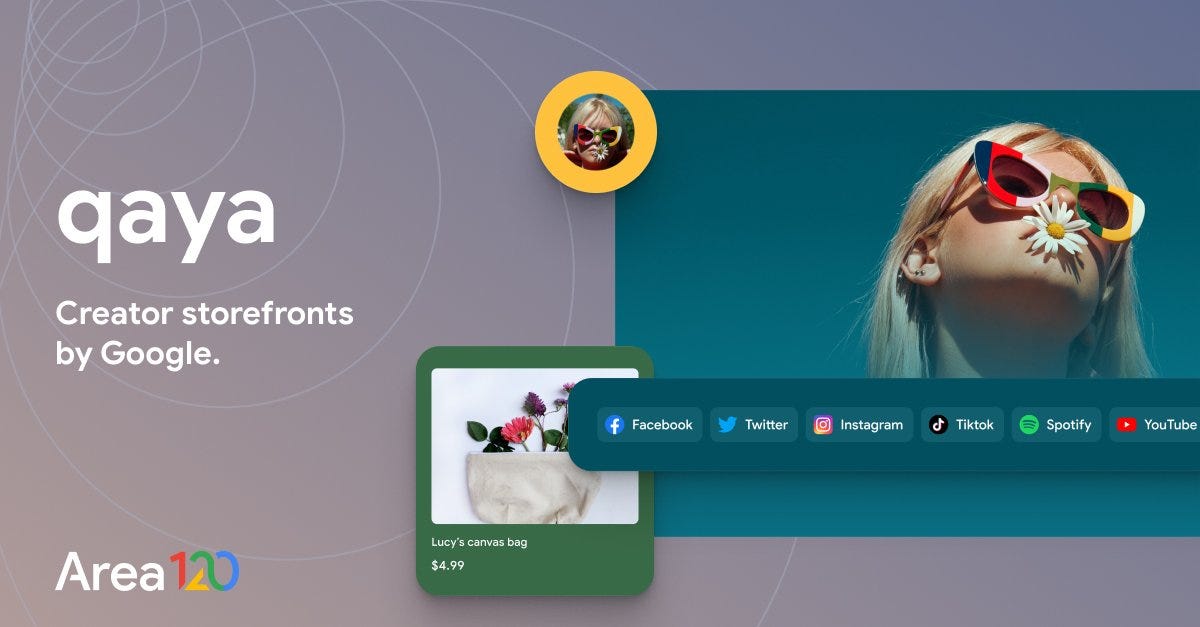

Google is launching Qaya for creators to set up webstore fronts 👀

Thursday, 16th December 2021 by Gotrade

Hey Gotraders,

The team at Google (GOOG) has launched a unique new service called Qaya.

What is Qaya? Qaya is a platform that creators can use to create a virtual storefront to sell their products and services.

Some features of Qaya:

Each store will get its own custom URL

Creators will be able to feature links to their other online profiles

Up to 1,000 products can be hosted per storefront

The virtual storefront will be connected to the YouTube merch shelf, Google Search and Google Shopping

YouTube Merch Shelf integrations for eligible YouTube creators who join Qaya’s Beta are currently being rolled out

There is an import function that allows the creator to feature physical goods or services that they sell on other platforms on their Qaya page, complete with their own personal branding

Qaya supports a variety of monetization options, such as subscription, tipping and one-time payments

There’s an analytics dashboard for the creators

“Other types of digital goods” will be rolled out in the future. This sounds like code word for “NFTs” but Google isn’t confirming that just yet!

Google Pay is inbuilt into Qaya

Why Qaya? Qaya aims to simplify the process of building a digital business for creators. The existing creator tools in the market aren’t that easy to use and usually require coding. Qaya aims to serve as a flexible, no-code product that could function as a one-stop-shop where creators can make money from their work and better connect with their audiences.

Qaya is launching in Beta version today in the U.S., though non-U.S. users can join a waitlist while they wait for Qaya to be rolled out in their country. Creators who want to try Qaya’s Beta version can request an invitation from the Qaya website.

Qaya is part of Google’s in-house project incubator - Area 120. Area 120 is an in-house team that trials and tests out new products and services.

Why is this important? Alot of people have pivoted to either freelancing or becoming a creator of sorts during the pandemic. Some people became Tik Tok stars or influencers, while others started their own business from home.

Bottom line is - “the pandemic has been very, very good for the creator economy.”

This makes Qaya a very relevant product at the moment!

Well, hopefully this product makes it to market!

Shares of Google closed at $2,947.37, up 1.65% for the day.

📈 Cathie Wood goes shopping for XPeng 🛒

Cathie Wood went shopping on Tuesday and scooped up some shares of XPeng (XPEV). She bought 97,697 shares worth around $4.34 million. She already held 524,034 shares worth $23.74 million prior to Tuesday’s purchase.

She added these shares to her Ark Autonomous Technology & Robotics ETF (ARKQ).

Ms Wood also bought 11,671 shares of Coinbase (COIN) worth around $3 million.

Shares of ARKQ closed at $77.03, up 0.25% year-to-date.

📈 Intel plans to invest $7 billion in a new plant in Malaysia 🇲🇾

Following the global semiconductor shortage, Intel (INTC) plans to build its own plant in Malaysia. The plant is expected to cost over $7 billion and will begin production in 2024.

The new plant will create thousands of new jobs. Specifically, it will create 4,000 Intel jobs and more than 5,000 construction jobs in Malaysia. Nice!

“This undertaking is indeed timely given the bullish global demand driven by the chip shortages and the potential challenges arising from the recovery of the pandemic globally” - Mohamed Azmin Ali, Malaysian Minister of International Trade and Industry.

Shares of Intel closed at $50.67, up 1.95% for the day.

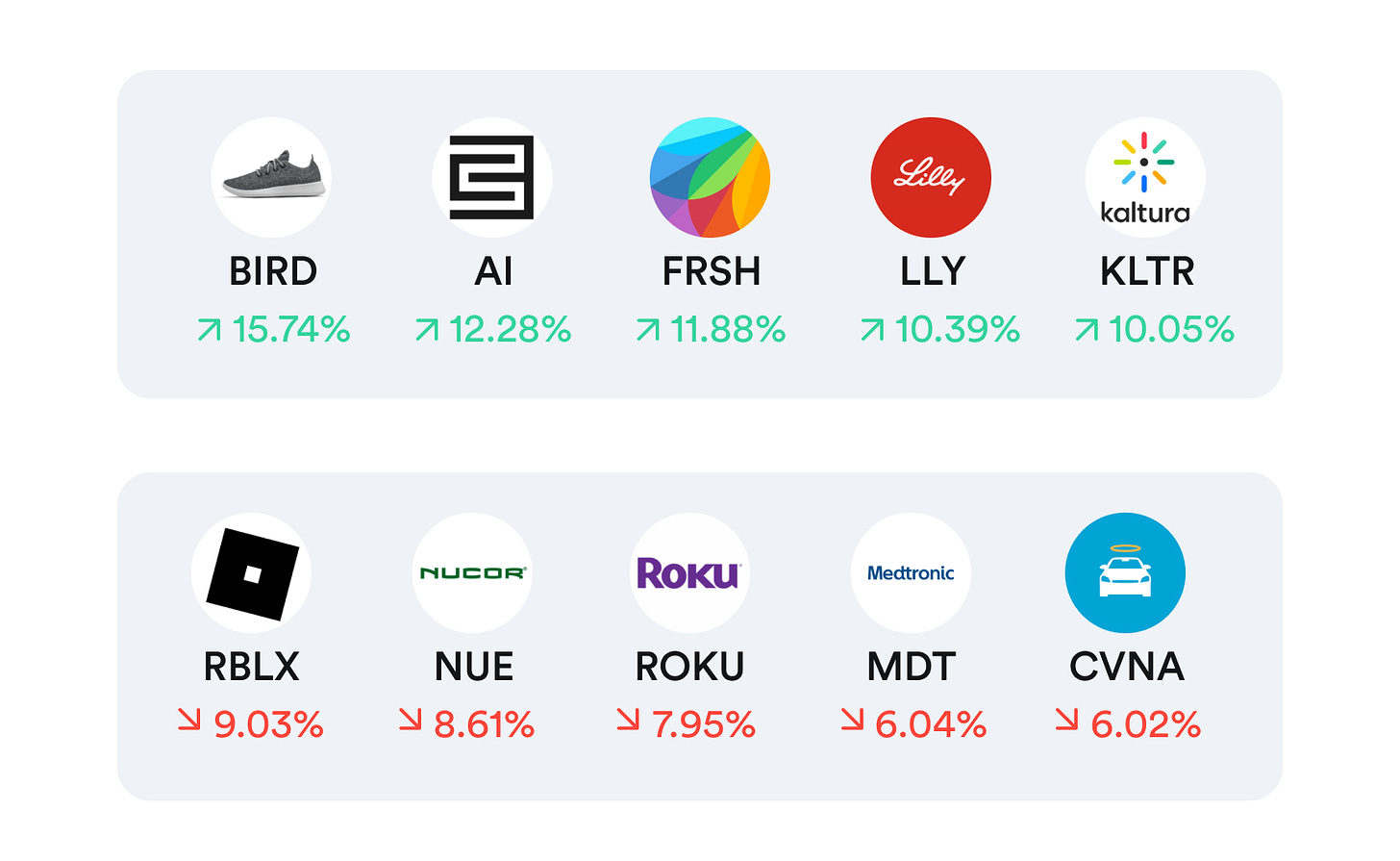

Top movers & shakers 🎢

What else is making headline news 📰

Jim Cramer says the Santa Claus rally may have started early this year. Here’s why.

Ex-McKinsey partner pleads guilty to insider trading in Goldman Sachs (GS) fintech deal.

Fauci says Covid boosters work against omicron, no need for variant-specific third shot.

Dow jumps 380 points, Nasdaq surges 2% in relief rally after Fed gives rate-hiking timeline.

The 'FAAMG' trade is dead but Apple's (AAPL) appeal stays alive with retail buyers and a $90 billion buyback arsenal, research firm says.

Cathie Wood's ARK Innovation fund (ARKK) falls near 15-month low ahead of Fed meeting.

Amazon (AMZN) promotes former Prime boss to oversee health efforts.

French taxi company suspends Tesla (TSLA) after Paris accident.

Two Moderna (MRNA) doses provide a substantially low neutralizing effect against Omicron.

EU regulator backs Johnson & Johnson (JNJ) COVID-19 booster dose for adults.

Apple (AAPL) temporarily closes three stores in response to rising Covid rates.

Popular companies releasing earnings this week 💰

Thursday: Rivian (RIVN), FedEx (FDX), Adobe (ADBE), Accenture (ACN), Expensify (EXFY), Cronos Group (CRON)

Friday: Darden Restaurants (DRI)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).