Video source: Tokopedia’s YouTube channel

Hey Gotraders,

Happy Monday! Let’s kick off the week with some exciting news… Are you ready…..?

We have been hearing rumors of the possible merger between Indonesia’s ride-hailing and payments giant Gojek and e-commerce player Tokopedia for a while now… And it just became official today! Southeast Asia’s two biggest startups have finally merged and the result of that merger is… *drumroll please*…. GoTo Group!

Is this a big deal? Hell, yeah! According to GoTo, the deal is the “LARGEST-EVER” business combination in Indonesia and the largest between two Asia-based Internet media and services companies to date! The plan is for the merged company to go public in a dual listing in New York and Jakarta via SPAC mergers. The question on everyone’s mind is - who will GoTo merge with in a SPAC deal?! Hmmm... 🤔

Deets of the merger: Both Gojek and Tokopedia will continue to exist as stand-alone brands.

Gojek’s Co-CEO Andre Soelistyo will lead GoTo as Group CEO. He will also lead the payments and financial services unit, which will be rebranded as GoTo Financial.

Tokopedia’s President Patrick Cao will take on the role of Group President.

Kevin Aluwi, the other Co-CEO of Gojek will remain on as CEO of Gojek.

William Tanuwijaya, Co-Founder & CEO of Tokopedia will continue to lead Tokopedia.

The GoTo Group will be backed by the big boys who previously invested in Gojek or Tokopedia. These include Alibaba Group (BABA), Astra International, BlackRock (BLK), Capital Group, Facebook (FB), PayPal (PYPL), Google (GOOG), JD.com (JD), KKR (KKR), Sequoia Capital India, Telkomsel, Temasek, Tencent and Visa (V), just to name a few.

Why is this important? The merger aims to combine Gojek’s high volume, high frequency mobility transactions with Tokopedia’s high value, medium frequency e-commerce transactions. The GoTo Group will have a total of 100 million active users. According to Soelistyo, Gojek drivers will deliver more packages from Tokopedia while the two firms will use their combined scale to focus on increasing financial inclusion in the region. The GoTo Group will account for more than 2% of GDP in Indonesia! That is absolutely incredible!

This merger will help Gojek and Tokopedia to compete against the larger rivals in the region such as Grab (AGC) and Sea (SE). Watch out, guys! There’s a new competitor in town! Just last month, Grab went public in a blockbuster SPAC merger.

📈 Airbnb bookings are up over 50% as vacation rentals pick up 👏

Airbnb (ABNB) stock closed around 4% higher on Friday. They reported $887 million in Q1 revenue (up 5% year-on-year). Gross booking value, which is the total amount of nights and experiences booked, increased by 52% to $10.3 billion!

According to Airbnb, this is due to a shift in consumer behaviors. People are starting to book entire home reservations, make group bookings (ie traveling with family instead of solo trips) and booking stays of more than 7 nights.

Airbnb’s CEO thinks that these changes in trends can be attributed to the easing of travel restrictions and the rollout of the vaccines. People are able to move around more freely and are also willing to work and live from remote locations.

📉 Aurora Cannabis stock slides after disappointing quarter 👎

Stocks of Aurora Cannabis (ACB) are down over 6% after they reported disappointing earnings. They reported a net loss of around $136 million for its quarter due to a sharp drop in recreational cannabis sales. Their medical marijuana division however showed some strength relative to competitors. They also announced a shake-up of their Board of Directors. Hmmm….

Stocks of Aurora Cannabis closed at $6.86.

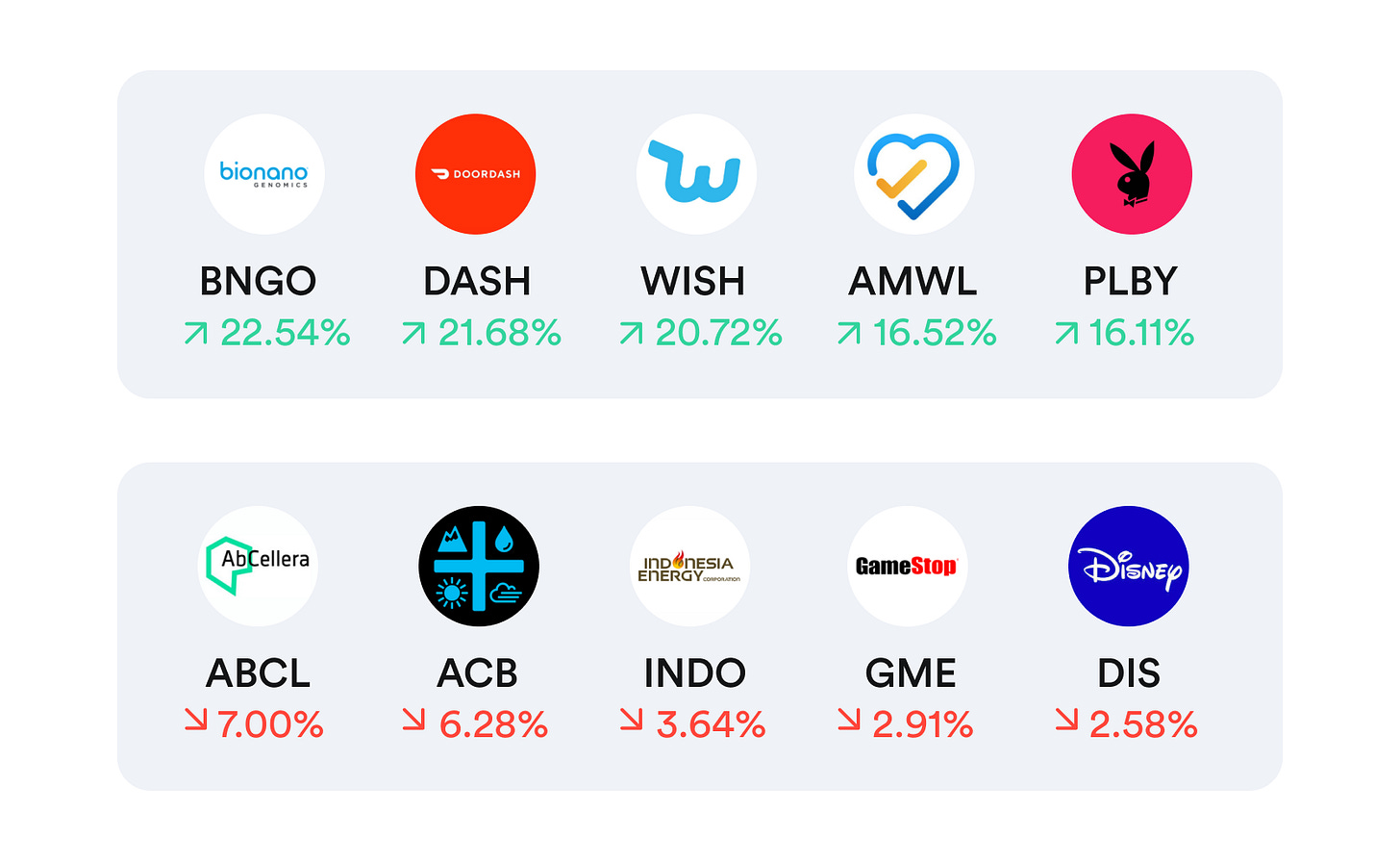

Top movers & shakers 🎢

What else is making headline news 📰

Elon Musk’s net worth dropped $20 billion following his ‘Saturday Night Live’ performance.

Twitter (TWTR) & Square (SQ) CEO Jack Dorsey says he's committed to making Bitcoin work better.

Tesla (TSLA) may be much worse off in China than anyone thought.

Ryanair (RYAAY) says business ‘continues to be challenging’ as traffic falls 81%.

Stock index giant MSCI to start tracking Alibaba’s Hong Kong shares instead of U.S. shares (BABA).

Popular companies releasing earnings this week 💰

Monday: Ryanair (RYAAY), Tencent Music (TME), Ideanomics (IDEX)

Tuesday: Walmart (WMT), Home Depot (HD), Sea (SE), Baidu (BIDU), Trip.com (TCOM), Take-Two Interactive (TTWO), Advance Auto Parts (AAP), Ascendis Pharma (ASND)

Wednesday: Cisco (CSCO), Lowe’s (LOW), JD.com (JD), Target (TGT), TJX (TJX), Analog Devices (ADI), Synopsys (SNPS), Copart (CPRT), Keysight (KEYS), Futu (FUTU), Victoria’s Secret (LB)

Thursday: Applied Materials (AMAT), Ross Stores (ROST), Hormel Foods (HRL), Plug Power (PLUG), Polo Ralph Lauren (RL), Deckers Brands (DECK), Manchester United (MANU), Apartment Investment (AIV)

Friday: John Deere (DE), VF Corp (VFC), Booz Allen (BAH)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).