Hey Gotraders,

Happy Monday 😊 It’s a brand new week!

We have several interesting companies reporting earnings this week - AMC (AMC), Jumia (JMIA), Coinbase (COIN), Playboy (PLBY), ThredUp (TDUP), FuboTV (FUBO), Nio (NIO), Coupang (CPNG), Bumble (BMBL), Disney (DIS), Palantir (PLTR), DoorDash (DASH), and many more! Refer to our earnings calendar below.

Warren Buffett’s company, Berkshire Hathaway (BRK.B) reported earnings on Friday. Let’s take a look at some of the key stats they reported:

The company reported $6.69 billion in operating profits, a strong 21.8% rise from $5.51 billion reported a year ago. This was mainly powered by its diverse manufacturing businesses that benefited from the economy's reopening.

Berkshire’s cash pile stood at $144.1 billion at the end of June.

The company continued with its aggressive buyback program and repurchased $6 billion of its own stock in the quarter.

The company reported overall earnings of $28.1 billion, up 6.8% year on year.

Why is this important? Cha-ching! 💰 The company has a massive amount of excess cash and they chose to reinvest in themselves by buying back its own stock aggressively. They bought back a total of $12.6 billion of its own stock in the last six months, and a record $24.7 billion last year!

Berkshire Hathaway cautioned that the quarterly results looked amazing as they were being compared to last year’s figures which were negatively impacted by the pandemic. They are also unsure of when the results will “truly return to normal.”

“The COVID-19 pandemic adversely affected nearly all of our operations during 2020 and in particular during the second quarter, although the effects varied significantly. The extent of the effects over longer terms cannot be reasonably estimated at this time” - Berkshire Hathaway.

Berkshire Hathaway Class B stock (BRK.B) are up over 25% year-to-date and closed at $285.63.

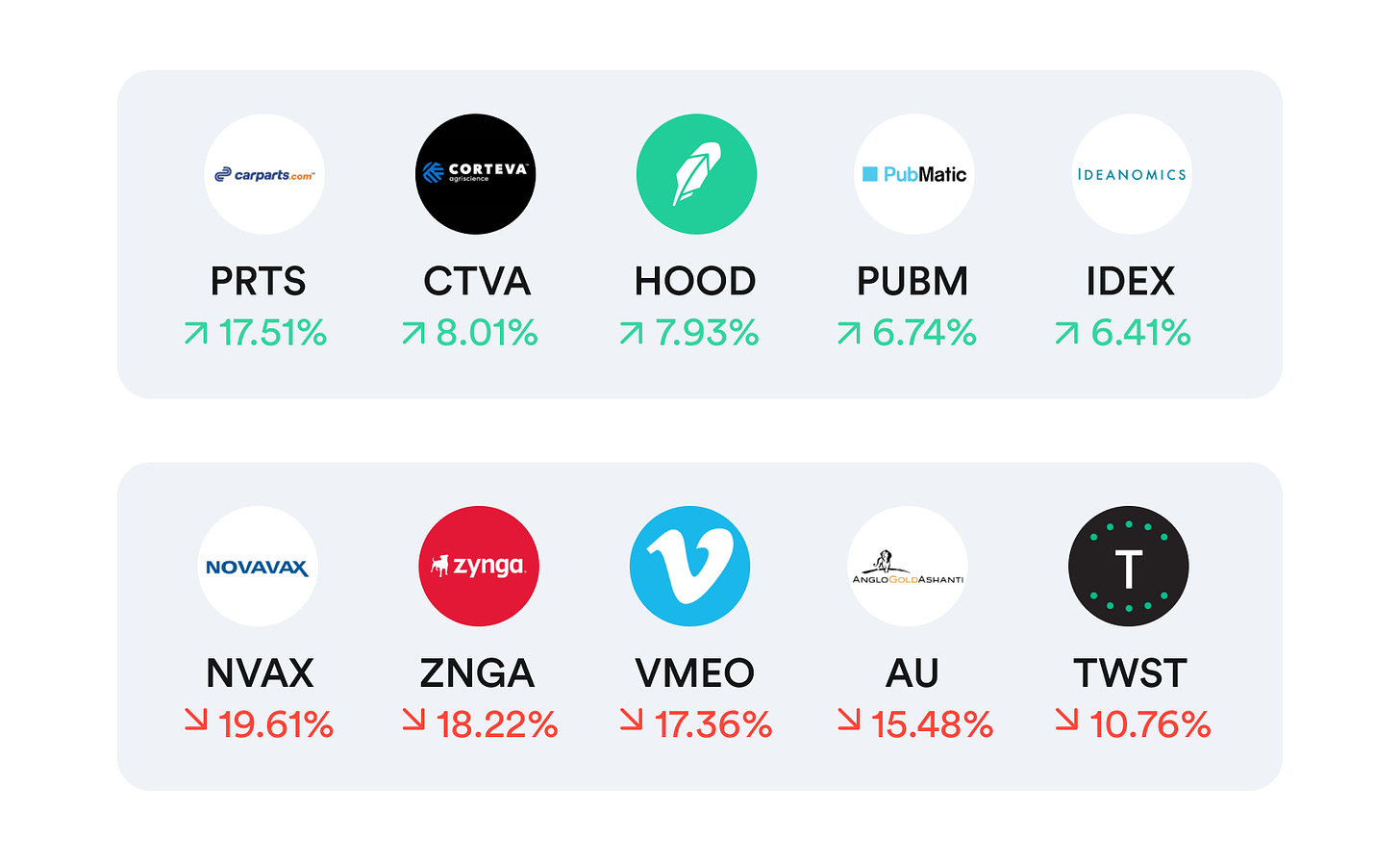

📉 Novavax loses nearly 20% of its value 🤕

Shares of Novavax (NVAX) are down nearly a whopping 20% after it delayed submission for its Covid-19 vaccine to be used in the US for the third time! The company now expects to apply for emergency-use authorization in the US in the last quarter of this year. Novavax also missed on its second-quarter earnings expectations, which has put pressure on its stock price. They reported a loss of $4.75 per share, while analysts were expecting a loss of $3.63 per share. Yikes!

Shares of Novavax are down 39.88% over the last 6 months and closed at $189.89.

📉 Shares of Zynga are down over 18% lower ⏬

Shares of video game developer Zynga (ZNGA) crashed and closed over 18% lower on Friday when they warned investors that its growth rate will start to decline once economies reopen. People will start to play fewer video games, and this will negatively impact its player engagement levels and gaming revenue. Zynga cut its full-year forecast for bookings (a key sales metric that accounts for changes in deferred revenue) by 3% to $2.8 billion.

Shares of Zynga are down 29.48% over the last 6 months and closed at $7.99.

Top movers & shakers 🎢

What else is making headline news 📰

Exxon Mobil (XOM) considers pledging ‘Net Zero’ carbon by 2050.

Why millennials and gen-Zs are jumping on the buy now, pay later trend.

Verizon (VZ) and AT&T (T) plan a post-pandemic 5G marketing blitz, even as consumer use cases remain unclear.

Amazon (AMZN) invested millions in a pre-revenue company with a system for measuring human proteins.

Amazon (AMZN), Google (GOOG), and other tech companies join government efforts to fight ransomware.

$1 trillion infrastructure bill awaits final vote after Senate breaks filibuster, shuts down debate.

Apple (AAPL) will report images of child sexual abuse detected on iCloud to law enforcement.

Popular companies releasing earnings this week 💰

Monday: Dish Network (DISH), AMC (AMC), Aterian (ATER), TheTradeDesk (TTD), Agora (API), AECOM (ACM), Tyson Foods (TSN), Viatris (VTRS), Barrick Gold (GOLD), CF Industries (CF), Air Products & Chemicals (APD)

Tuesday: Jumia (JMIA), Coinbase (COIN), Playboy (PLBY), ThredUp (TDUP), FuboTV (FUBO), Unity (U), Newtek (NEWT), Sysco (SYY), Aramark (ARMK), McAfee (MCFE)

Wednesday: NIO (NIO), Coupang (CPNG), Wix.com (WIX), Bumble (BMBL), Payoneer (PAYO), Amwell (AMWL), Opendoor (OPEN), eBay (EBAY), Perrigo (PRGO)

Thursday: DoorDash (DASH), Disney (DIS), Palantir (PLTR), Airbnb (ABNB), Baidu (BIDU), Wheaton Precious Metals (WPM), Tattooed Chef (TTCF), IQIYI (IQ), AbCellera (ABCL), Wish (WISH), Arko (ARKO), SoFi (SOFI), Algonquin Power (AQN), AEGON (AEG)

Friday: The Honest Co (HNST)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: TR8 Securities Inc., trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of TR8 Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. TR8 Securities Inc. is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).