Meta plummets over 20% after reporting earnings 🙈

Thursday, 3rd February 2022 by Gotrade

Hey Gotraders,

Investors were expecting to hear Meta share deets about their Metaverse ambitions on its earnings call on Wednesday. However, Meta posted a profit decline - which rarely ever happens.

This is partly due to the company’s heavy spending on developing its Metaverse vision, as well as confronting advertising challenges on its existing services.

They reported net income of nearly $10.3 billion for the final quarter of the year, a decline of 8% from the same period in the prior year. It goes without saying that this was wayyyy below Wall Street analysts' projections. Ouch!

Meta also said that revenue growth in the current quarter could be as low as 3%, a sharp deceleration from a gain of 48% in the quarter a year ago.

Why is this important? The forecast that Meta gave raises questions not just about its growth outlook, but about the broader online advertising industry and shifting consumer behavior. As the pandemic eases up, are people using social media less? Decelerating use of the company’s primary services, tough earnings comparisons, and reduced spending by advertisers who are having issues related to inflation and supply-chain issues led the company to give its bleak guidance. Changes to Apple's iOS will also cost Meta a reported $10 billion this year. Yikes!

Shares of Meta closed down more than 22% in after-hours trading, wiping off more than $175 billion off its market cap.

Meta’s fundamentals remain strong and the company still has a healthy cash flow of $48 billion, according to the fourth-quarter report. Analysts at Cestrain Capital Research reiterated their “Buy” rating on Meta.

Shares of other social media companies such as Pinterest (PINS), Snap (SNAP), and Twitter (TWTR) also fell following Meta’s earnings report.

📈 Shell reports record profit, boosts dividends and buybacks 🚀

Consumers might whine about higher oil and gas prices as that translates to higher fuel and electricity bills for them. But guess who’s not complaining? Energy companies. Take Shell (SHEL) for example. They reported record profits of $6.4 billion due to surging prices of oil and gas.

They are sharing their profits with their shareholders and announced a dividend hike of 4% in the first quarter of 2022 to $0.25 per share. Cha ching!

Shell will also be using the heaps of cash they have laying around to buy back $8.5 billion of its own shares in the first half of 2022, including $5.5 billion from the sale of its Permian shale assets in the United States. They bought back $3.5 billion of their own shares in 2021.

"2021 was a momentous year for Shell" - Ben van Beurden, CEO of Shell.

Looks like they are rollin’ in cash, eh?!

Shares of Shell closed at $53.25, up 1.08% for the day.

P.S. Please note that Shell has changed its name and ticker to Shell (SHEL).

📉 PayPal closed over 24% lower. Cathie Wood bought the dip 🛒

Shares of PayPal (PYPL) closed over 20% lower after reporting earnings. They reported mixed results for the last quarter of the year. Earnings missed analysts’ expectations, although revenue beat expectations. They also gave weak guidance for the first quarter of 2022.

Ms Cathie Wood decided to buy the dip on the stock. Let’s take a look at a few of her recent trades.

Bought 1,931 shares of Tesla (TSLA) - shares are down 24.51% year-to-date

Sold 158,126 shares of PayPal (PYPL) - shares are down 31.99% year-to-date

Bought 549,034 shares of Block (SQ) - shares are down 30.48% year-to-date

Bought 32,492 shares of XPeng (XPEV) - shares are down 28.78% year-to-date

Shares of PayPal closed at $132.57, down 24.59% for the day. Shares are down a further 2.47% in extended trading at the time of writing.

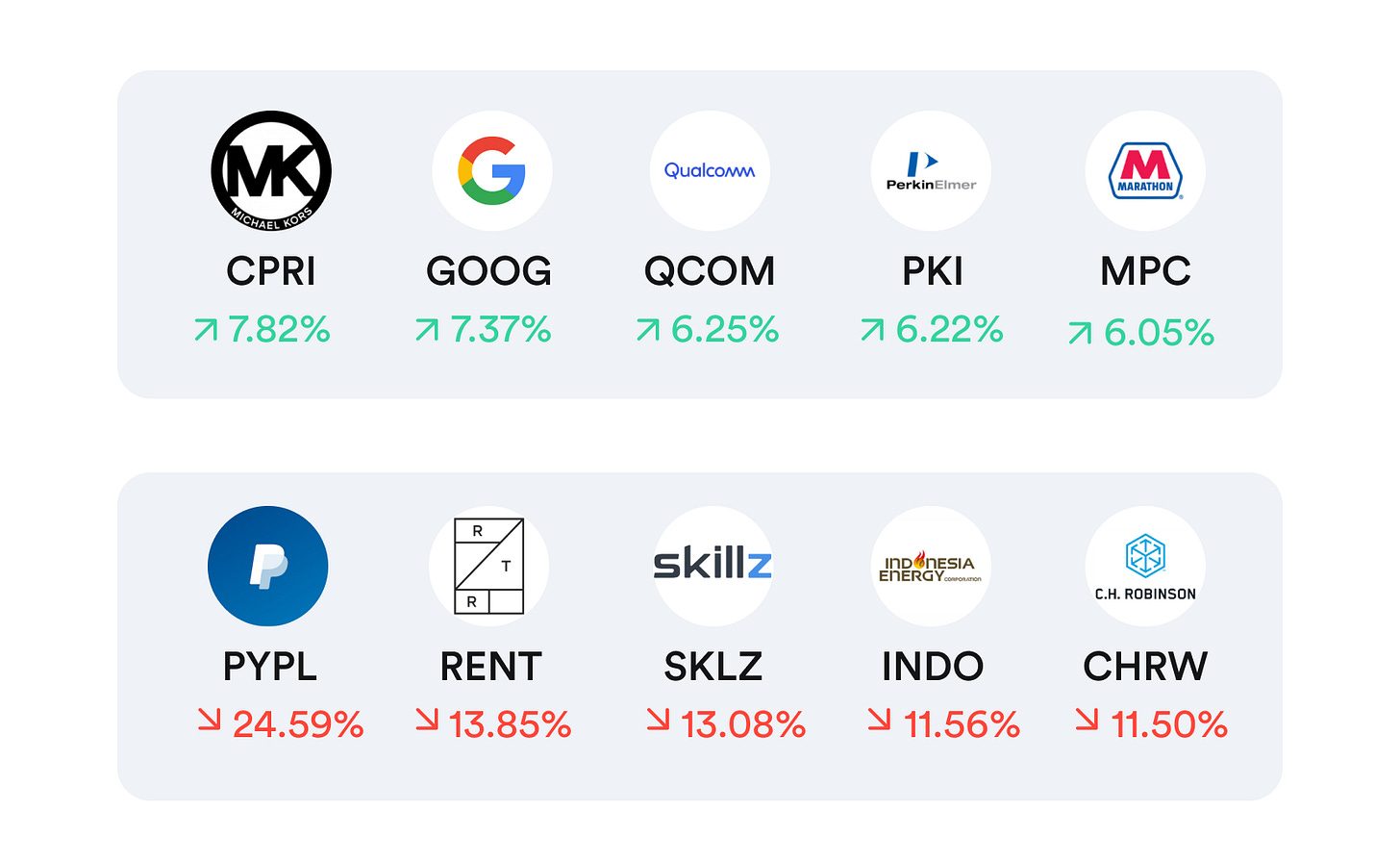

Top movers & shakers 🎢

What else is making headline news 📰

Amazon (AMZN) Q4 earnings preview: Supply chain constraints to pressure margins.

Stocks rise for a fourth straight session: S&P 500 gains 0.9%, Dow adds 224 points, or 0.6%.

Spotify (SPOT) stock plunges on middling user growth projections.

Qualcomm (QCOM) beats expectations for revenue and earnings, sales up 30%.

Ferrari (RACE) has a lot riding on its new SUV, the Purosangue.

Starbucks (SBUX) CEO says airport cafe closures, low traffic to offices weighed on Chinese sales.

China's JD.com (JD) CEO joins billionaire charity rush with $2.3 billion share pledge.

Alphabet (GOOG) eyes $2 trillion value after blowout results.

Nokia (NOK) resumes dividend, share buybacks as turnaround gathers pace.

Popular companies releasing earnings this week 💰

Thursday: Amazon (AMZN), Ford (F), Pinterest (PINS), Activision (ATVI), Snapchat (SNAP), Polo Ralph Lauren (RL), Lilly (LLY), Merck (MRK), Shell (RDS.A), Coach (TPR), Wynn Resorts (WYNN), Honeywell (HON), Unilever (UL), Biogen (BIIB), ConocoPhillips (COP), Estee Lauder (EL), CIGNA (CI), Illinois Tool Works (ITW), Becton Dickinson (BDX), Intercontinental Exchange (ICE), ABB (ABB), Fortinet (FTNT), Prudential Financial (PRU), Hershey's (HSY), Parker-Hannifin (PH), Microchip Technology (MCHP), Aptiv (APTV), Cummins (CMI), Nokia (NOK), AMETEK (AME), Wec Energy Group (WEC), Unity (U), Fortive (FTV), Hartford Financial (HIG), Skyworks Solutions (SWKS), Clorox (CLX), CMS Energy (CMS), Xylem (XYL), Carlyle Group (CG), Quest Diagnostics (DGX), Tradeweb Markets (TW), Bill.com (BILL), NortonLifeLock (NLOK), ABIOMED (ABMD), Dolby Labs (DLB), Arrow Electronics (ARW), Deckers Brands (DECK), RGA Re (RGA), Advanced Drainage Systems (WMS), Penn National Gaming, Inc (PENN), GoPro (GPRO)

Friday: Bristol-Myers Squibb (BMY), Sanofi (SNY), Regeneron (REGN), Eaton (ETN), Air Products & Chemicals (APD), Aon (AON), BBVA (BBVA), Cboe Global Markets (CBOE), Twist Bioscience (TWST)

A company’s market value may fluctuate considerably around the time that the earnings report is expected to be published. Stock prices may rise or fall according to analysts' speculative estimates, released prior to the actual earnings announcement.

The earnings season can be a time of great opportunity since better-than-expected figures could cause a company’s stock to greatly increase in value. Worse-than-expected results could have the opposite effect.

That’s all from us for now.

Signing out,

Enjoyed the newsletter? 🤗

Why not share with your family or friends who may be interested in starting their investing journey. Simply forward this newsletter - all they got to do is click the “Subscribe Now” button below… Or they can get the Gotrade app - they’ll automatically become a subscriber.

The legal stuff 🤓

Disclaimer: Gotrade Securities, trading as Gotrade, provides this service as general information only, without taking into account your circumstances, needs, or objectives. You should consider the appropriateness of any forecast or other information herein for your individual situation. If in doubt, you should seek independent professional advice.

Gotrade utilizes financial information providers and information from such providers may form the basis for analysis. Gotrade accepts no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of Gotrade or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of Gotrade Securities or any of its affiliates, subsidiaries, officers, or directors.

All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products. Gotrade Securities is licensed to carry on business as a Labuan Securities Licensee under the Labuan Financial Services and Securities Act 2010 (License No. SL/20/0014).